Tuesday, December 12, 2006

Edu Exchange - lessons learned from the banks

On the Edu Exchange conference, one of the keynote speeches was given by Gerard Hartsink of ABN AMRO, who is heavily involved in the standardisation of monetary traffic between banks. A great idea, though somewhat flawed in execution: he clearly gave the default talk, which had way too many details of the intricacies of the problems encountered [1]. The talk would've been better if he had focussed more on the general problems, rather than for instance, showing all the consortium members in a long series of logo-filled slides.

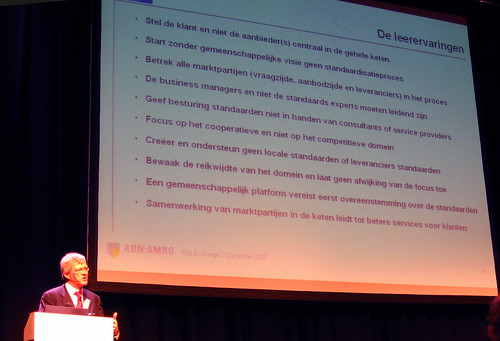

Still, the final slide with the lessons learned from the troubles of standardisation had some nice ones for our field.

Put the customer in the centre of the chain, not the supplier.

A good reminder - especially since the customers are usually not involved at all in the work, they are the ones we're working for.

Don't start a standardisation process without a common vision.

The Dutch banks learned it the hard way, sinking > 200 mln EUR in to incompatible 'chip wallet' systems.

Business managers, not the experts on standards need to be leading.

Interesting tidbit: One of the directors of Ahold, Ab Heijn, played an instrumental role in the international barcode association.

Do not hand over the control over standards to consultants or service providers.

Not only is the standard at risk, less involvement of the partners means less commitment.

All easier said than done, and all cliches, of course. But still true.

[1] As it turns out in the EU, most countries have developed their own system for paying with debit cards, and even if the same technical standard was used such as in Belgium and Germany, the content standard makes cooperation even harder. An extra layer on top of the national standards is needed to make it possible; the architecture of which is pretty nightmarish.

Subscribe to:

Posts (Atom)